Enforce claims against Dolphin Trust / German Property Group now!

Opening of insolvency proceedings on the assets of Dolphin Trust / German Property Group

Have you purchased any Dolphin Trust-German Property Group products? Protect your investment!

Quick contact

In response to the apparent confusion which seems to surround exactly what our services are we would like to summarize our activities for you and explain our fees that we charge

Insolvency Process

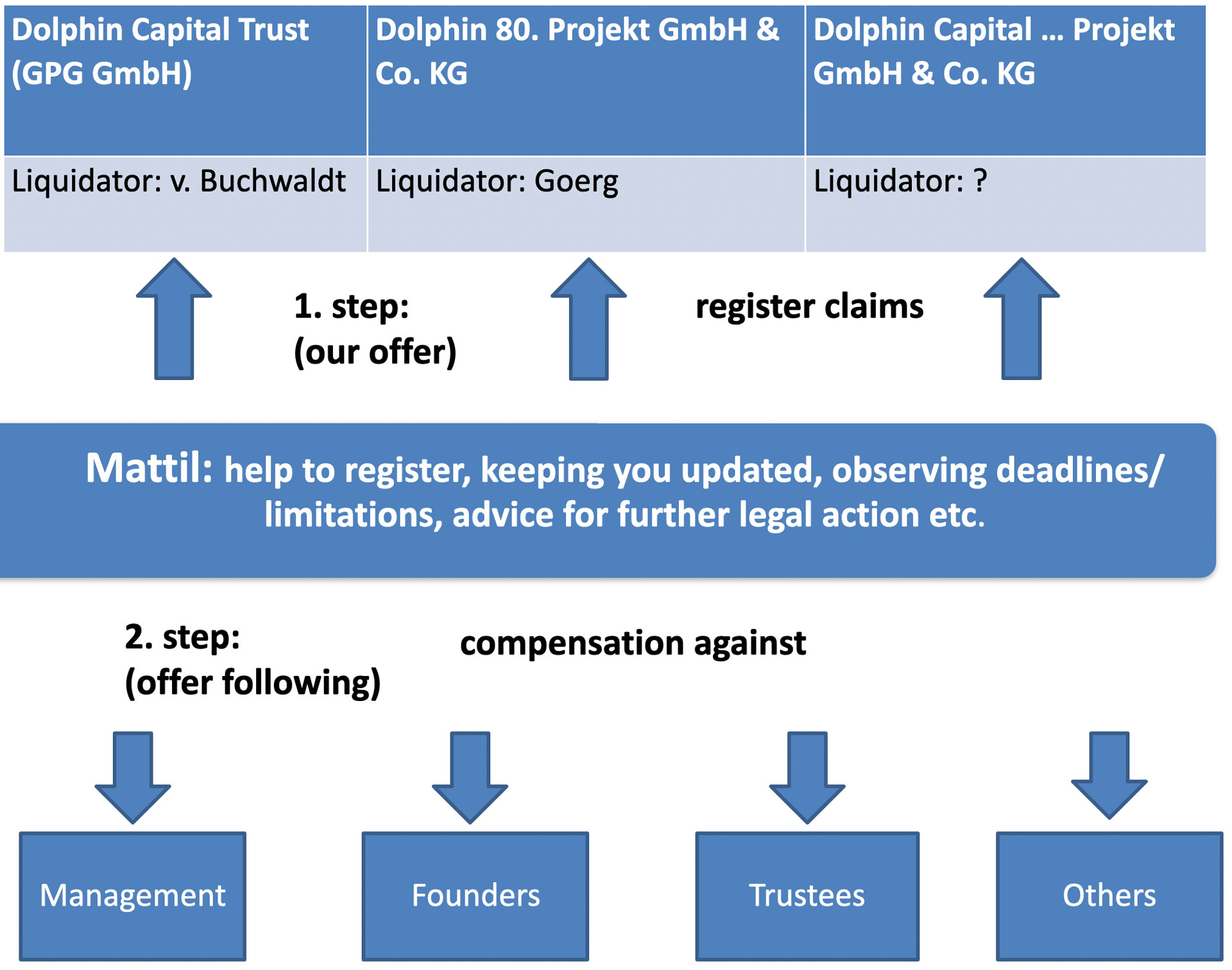

We understand that more than 200 Dolphin companies exist and will subsequently enter into insolvency procedures. Currently there is only one insolvency procedure open: AS German Property Group GmbH (former Dolphin Capital Trust GmbH). The many singler purpose vehicle companies, such as Dolphin Capital 80 KG, will follow in due course. As this process unfolds we have to observe the fate of this entire group and recommend to you measures to take where necessary or appropriate.

Step 1

We will register and prove your claim to the liquidator of GPG GmbH. It is possible that the entire Dolphin Group will result in one insolvency procedure but this is not certain yet. At the moment the court has appointed two different liquidators, GOERG Preliminary Administrator of DC 80 and others) and BBL. If we face more than one insolvency procedure, we will have to register the claim again. As circumstances evolve we will deal with any changes or amendments throughout the process of the group’s insolvency.

We charge you with one fee, that is the minimum legal fee that German law requires for attorneys activities in an insolvency procedure. In our experience, insolvency procedures take many years and will be difficult for you to pursue and understand. Included in our fee is the assistance during the following years, advice and recommend legal steps when required. Our services are comprehensive and attorney Peter Mattil as one of the most experienced lawyers in Germany for insolvency / investment cases.

In cases of hardship we are prepared to allow this cost to be spread over several years.Please contact us directly in this regard.

What will happen next?

Following the court appointment, the liquidator will have to gain control over the entire Dolphin Group by opening the procedures for each individual company in the Group and some that are linked to the Group. The liquidator (or liquidators) will investigate the movement of all the estimated 1 bn invested money, trace ownership and security and evaluate and sell the properties in Germany. This could take years and involve great efforts as you can imagine. Some of the properties are valuable, others only scrap. Our service is to explain,inform,represent and guide you through this process, providing answers to the many questions that may arise.We will correspond to you directly, if you are our client.

Once your claim is registered and accepted we will enter into step 2.

Step 1

You can, hopefully, expect a dividend from the insolvency procedure but we cannot estimate this now. We cannot predict whether the tracing of money will be successful or the realisable values for the sale of properties. It is likely that you will suffer a significant loss and you will search for compensation, which will be pursued by us parallel to the insolvency procedures.

We will identify potential claims against any responsible persons;Directors of the Dolphin Group,security trustees, notaries and other parties can be liable for your losses. We will obtain more information in the future, from the liquidators, prosecution and others. Once we have examined all documents and evidence, we will revert to you and propose further actions. Again, we can only do this for our clients.

We will look for a litigation strategy that is cost effective regarding attorney‘s and court fees. We do not have a “class action“ in Germany, comparable to the United States, but there are similar methods to pursue claims in a collective way. We will submit a strategy to you at a later date.

You can reach us at any time by e-mail or telephone in order to answer your questions.

16.10.2020

Asian investors entangled in $1.2bn German property scandal

Liquidator seeks to identify those who invested in redevelopment scheme

Attention! The insolvency court of Bremen has set a deadline for filing your claims at 25.November.

For this purpose we will need your investment contract an, if, amount of returns .

The forecasts of MATTIL's specialist lawyers for banking and capital market law have been confirmed. On 23.07.2020, insolvency proceedings were opened for the assets of AS German Property Group GmbH (formerly Dolphin Capital GmbH). In order to file for insolvency, the company moved its registered office from Hanover to Bremen.

AS German Property Group GmbH is a limited partner in numerous project companies. As a result, insolvency proceedings were also opened over the assets of the following project companies:

- Dolphin Capital 20. Projekt GmbH & Co. KG

- Dolphin Capital 26. Projekt GmbH & Co. KG

- Dolphin Capital 34. Projekt GmbH & Co. KG

- Dolphin Capital 36. Projekt GmbH & Co. KG

- Dolphin Capital 38. Projekt GmbH & Co. KG

- Dolphin Capital 40. Projekt GmbH & Co. KG

- Dolphin Capital 46. Projekt GmbH & Co. KG

- Dolphin Capital 76. Projekt GmbH & Co. KG

- Dolphin Capital 80. Projekt GmbH & Co. KG

- Dolphin Capital 92. Projekt GmbH & Co. KG

- Dolphin Capital 120. Projekt GmbH & Co. KG

- Dolphin Capital 134. Projekt GmbH & Co. KG

- Dolphin Capital 146. Projekt GmbH & Co. KG

- Dolphin Capital 150. Projekt GmbH & Co. KG

- Dolphin Capital 218. Projekt GmbH & Co. KG

LIST OF DOLPHIN PROJECT COMPANIES -->

All holders of bonds (SECURED CONVERTIBLE LOAN NOTES) of the affected project companies, especially the creditors of Dolphin Capital 80. Projekt GmbH & Co. KG, are strongly advised to file their claims in the insolvency tables.

We will be pleased to support you in filing your claims and enforcing your claims in the insolvency proceedings.

Press releases

about the Dolphin insolvency

The Telegraph London, 6. March 2021

Lloyds 'let down' victims of £1.5bn German property scandal

Thousands of British investors lost cash in the German property scheme

The Telegraph, 27. February 2021

Lloyds 'let down' victims of £1.5bn German property scandal

Thousands of British investors lost cash in the German property scheme

Daily Telegraph ( UK ) vom 20.2.2021

RA MATTIL zu German Property Group/Dolphin

Business Post ( Dublin) vom 20.12.20

RA Mattil zu Dolphin/German Property Group

BBC (Großbritannien):

Interview mit RA Mattil zu Dolphin Trust

Nikkei Asia: Asian investors entangled in $1.2bn German property scandal

16.10.2020

ARD Report München, Interview mit RA MATTIL zur Dolphin-Insolvenz

22.09.2020

Tagesschau: RA MATTIL zur Dolphin-Insolvenz

22.09.2020

Why go to MATTIL?

Trust in over

25 years of experience

Attorney Mattil is probably the most experienced lawyer in Germany in the area of investment law. Mr. Mattil sits in the creditor committee with numerous insolvent investment companies.

Bundle your interests at MATTIL. Much can be achieved by teaming up.

MATTIL has over 25 years of experience in investor protection.

Mattil is in the creditors' committee of numerous insolvent investment companies

First successful model case in Germany, conducted by MATTIL (KAP 1/07 v 30.12 11).

Comprehensive 25 year-long experience with all types of investments, in particular funds and interest-bearing securities

Clear and reliable agreement on fees (cost transparency).

For the third time in a row: Best Investment Law Firm in Germany (Handelsblatt/Best Lawyers 2015-2017).

Information about Dolphin Trust-German Property Group

In the companys register we discovered more than 150 companies belonging to GPG group, mostly Dolphin Nr ..KG . We try to investigate, if real estate property has been purchased and in favour of which company. It seems that many of these properties are not being renovated or restored, but decay without any sense. We think that an insolveny proceeding of the entire Dolphin group will be unavoidable and the only way to recover all assetes for investors. In Germany, an insolvency proceeding is strictly surveilled by court and controlled by the investors( creditors ).

Law firm MATTIL acts for investors of Dolphin 80. KG, who require a mature claim, without any paiment or explanation.

Contact Law firm MATTIL in order to obtain more information how to save your investment.